The perpetual growth formula is most often used by academics due to its grounding in mathematical and financial theory.

#IMPLIED PERPETUITY GROWTH RATE OF CASHFLOWS TV#

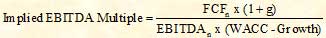

The perpetual growth terminal value formula is: TV = (FCFn x (1 + g)) / (WACC – g) Perpetual Growth DCF Formula For Calculating Terminal Value

Each approach has two major components: the forecast period and the terminal value. There are two main approaches for calculating terminal value: the perpetual growth model and the exit multiple model. Methods For Calculating The Present Value Of Terminal Value Need an experienced analyst to help determine the value of your business? Schedule a free discovery call with Valentiam. In this article, we’ll look at the different methodologies for calculating the DCF terminal value, and the limitations and risks to be aware of when using the terminal value in valuations.

When looking beyond that time frame, however, assumptions become increasingly nebulous and hypothetical, which is where the terminal value comes into play.

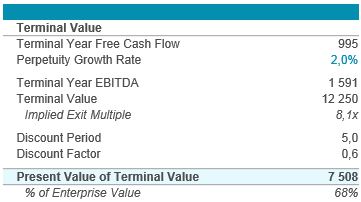

Terminal value represents expected cash flow beyond the forecast period, typically three to five years for a normal business this is considered to be a reasonable amount of time for making detailed assumptions about future performance. It typically comprises a large percentage of the total value of a subject business. The present value of terminal value is a critical factor for calculating a discounted cash flow (DCF) valuation report in the income approach to valuation.

0 kommentar(er)

0 kommentar(er)